The Employee Retention Tax Credit is a fully refundable payroll tax credit for employers who had to close, or partially close, their businesses due to COVID-19, as many child care centers did.

The good news is that the credit, which is part of the CARES Act, has been extended through Dec. 31 of this year.

These credits may deliver cash flow for your business as soon as you claim them. You can file for this credit for every quarter of 2021 on your form 941 filing, and may also receive an advance payment of a portion of the credit, according to the U.S. Treasury Department.

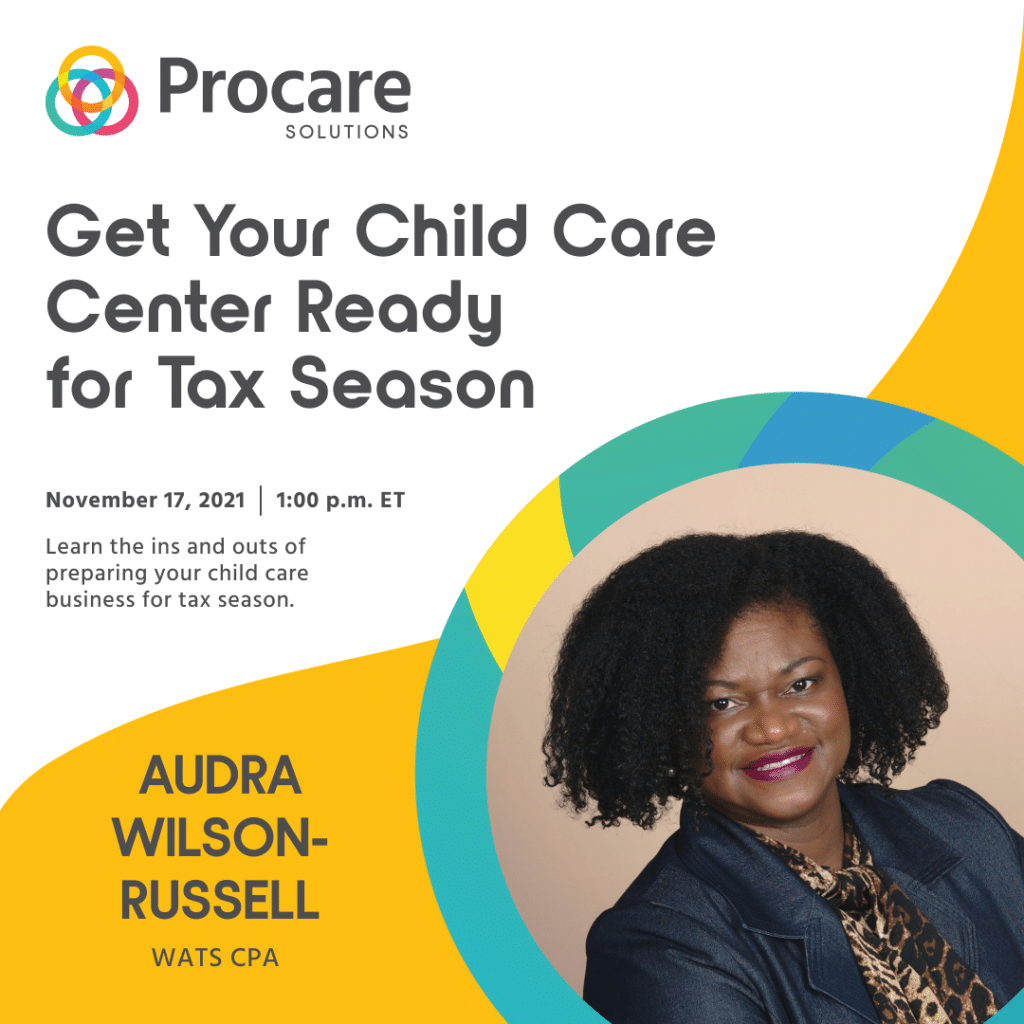

We asked Audra Wilson-Russell, a certified public accountant who specializes in helping child care providers and is the owner of Wats CPA, how the tax credit can be used for child care center owners.

Let’s jump in!

So how does the ERTC affect owners of child care centers?

The ERTC was created to encourage employers to keep their employees on the payroll while they navigate the effects of COVID-19. The ETRC is an important tax break that can help offset some of the costs associated with hiring new teachers and retaining existing ones.

One requirement is that owners show a “significant decline” in gross receipts to quality. What does that mean for child care providers?

These requirements for 2020 and 2021 differ.

For 2020, a significant decline is defined as a center that either had its operations fully or partially suspended due to COVID-19, or had a 50% or more decline in gross receipts compared to the same quarter in 2019.

For 2021, a significant decline is defined as a center that had its operations fully or partially suspended due to COVID-19, or had a 20% or more decline in gross receipts compared to the same quarter in 2019.

What amount of wages are eligible for the ERTC and how much is the potential credit?

Again, these requirements for 2020 and 2021 differ.

For 2020, it’s a 50% tax credit on qualified wages up to $10k per employee for the full year (i.e. max tax credit is $5,000 per employee for the full year).

For 2021, it’s a 70% tax credit on qualified wages up to $10k per employee per quarter (for example, the max tax credit is $7,000 per employee per quarter in 2021 through December 2021).

What time periods are eligible for the ERTC?

For 2020, the period is March 13, 2020 through Dec. 31, 2020.

For 2021, the period is Jan. 1, 2021 through Dec. 31, 2021

Which employees can businesses claim the ERTC for, and do the wages of family members qualify?

All non-related full- or part-time staff can be included. But family members’ wages must be excluded.

Are child care center owners who claimed a Paycheck Protection Program loan in 2020 eligible for the ERTC?

Yes. But they may not use the same wages for ERTC that were used for the PPP loan. For example, if the provider applied for forgiveness of the PPP loan using wages from quarter four of 2020, they can not turn around and apply for a ERTC for the same set of wages. No “double dipping”.

Is the ERTC taxable?

Not directly. The refund itself is not taxable, but it is a reduction to wages paid. So it will reduce the amount of wage expenses deducted on your tax return. Fewer deductions, of course, translates to higher taxes.

Let’s take a look at this example, broken down in a very simplified way: If your ERTC refunds totaled $40,000 and you are in the 25% tax bracket, your net effect would be a $30,000 benefit ($40,000 – $10,000 in taxes).

I already filed my 2020 tax return. If I receive the tax credit related to 2020, am I required to amend my tax return?

Yes. Since the credit reduces the amount of wages you may deduct, you need to amend it if you’re already filed your tax return.

And if your center is taxed as a partnership or an S corporation, you also will need to amend your personal tax return.

Any other advice you have for owners of child care centers who will seek or are considering seeking the ERTC?

Navigating the nuances of the ERTC can get a little tricky. If you are considering applying for either year of the ERTC, seek the assistance of an expert in the field.

If you are interested in learning if you qualify for this program, book a video call with Audra’s accounting firm today.

Audra recently spoke at Procare’s The Business of Child Care Conference and outlined the top five cash flow management tips you need to run a successful child care business. She also gave tips on creating and tracking cash flow projections, using accounting technology and implementing strategies to increase net profit.

And on Nov. 17, she’ll host a Procare webinar to teach the ins and outs of preparing your child care business for tax season. Register here to attend!