A vital component of your child care center’s budget is forecasting, which means predicting the financial future of your business.

How much money will you make by the end of the month, quarter or year? What will your expenses be?

By analyzing past financial performance, plus current revenue trends, you’ll be able to estimate business profits.

An accurate financial forecast will help you stick to your budget. When you understand how much money is coming in, you can better regulate how much money goes out, allowing you to manage cash flow effectively and avoid overspending.

Let’s take a look at four steps to incorporate forecasting into your child care center’s budget!

1. Get Your Financial Records Together

You can’t forecast the future without looking into the past. So gather your financial records from previous years, including your profit and loss statements, balance sheets, payroll reports and accounts payable and receivable details.

This task can be simply done with the help of child care management software, which can pull up the statements in seconds.

If you’ve just started your business and haven’t created a daycare budget plan, use your current income and expense numbers, industry growth standards and your own intuition. Keep an eye on your projections and adjust them as needed.

Remember that many child care centers drive less revenue between June and September because of family vacations, for example. WIth the help of forecasting, you can plan for that tuition decrease.

Consider setting aside money in the spring to help during leaner months, or use excess funds to market your child care business to secure new customers over the summer.

2. Choose What Method of Forecasting You’ll Use

There are two kinds of forecasts you need to be aware of: historical forecasts and research-based forecasts. In all likelihood, you’ll use a blend of both.

Historical forecasts use historical data such as previous income statements and balance sheets to predict future financial performance. Most daycare budget plans should start with historical forecasting.

Once you know the numbers for your own business, do your best to analyze the child care industry in your geographic location. Then use these details to help predict your finances down the road.

This type of forecast is pretty easy and usually doesn’t take much time. But because it doesn’t account for your entire industry, it’s not always completely accurate.

For example, your data could show that your child care business has grown by 20% year over year. But if the child care industry as a whole experiences significant changes (like a worldwide pandemic), your historical data alone won’t help you prepare.

Research-based forecasts use industry trends and competitor research to predict financial growth in the future. They analyze data from an entire industry and give detailed information about company growth potential, which is why many lenders like to see them. But they can also be expensive to conduct.

3. Create Your Child Care Center’s Forecast

First, analyze your financial records for the past few years. How has your business grown in that time?

Second, take a look at the entire child care industry. Do you foresee any massive changes? Take these things into account and adjust your revenue growth numbers if necessary.

Third, assess your personal goals. Are you happy with the amount of revenue you’re bringing in or do you want to grow at a faster pace? Should you consider hiring more employees or spending more on marketing?

Fourth, add up all your expenses including rent, utility bills and food, as well as estimated costs to reach your new revenue goals.

Add all this information to a spreadsheet so that you can easily see your projected revenue, gross profit, operating expenses, and net profit numbers in one place.

With child care management software, you can pull together all this information with a few clicks.

4. Analyze, Analyze, Analyze

You must analyze your forecasts on a regular basis to ensure you are on track to hit your goals. If you’re making more money than expected, develop a new budget to make sure you spend the extra money in the best way.

Forecasts are projections of what your business could make. Compare your actual results to your estimates to properly manage your business and ensure future forecasts are as accurate as they can be.

And if you plan to apply for a loan, either to get your daycare center up and running or expand operations, you’ll need to provide your lender with a financial forecast.

They’ll want to know how much money you’re currently bringing in, what you project to make in the future and how you plan to grow your business.

How Procare Can Help

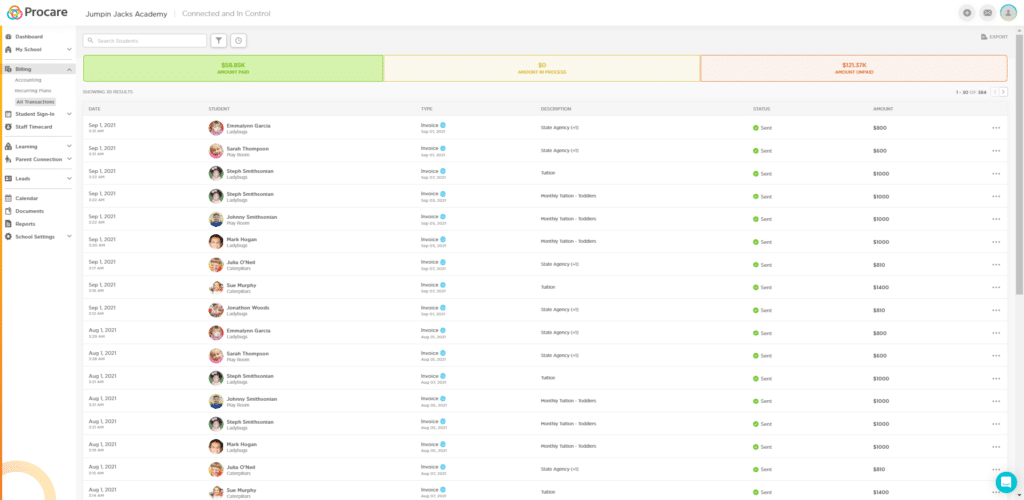

Procare has helped hundreds of thousands of early childhood professionals streamline child care management.

WithTuition Express, Procare’s child care billing software, you can view, control and automate your center’s cash flow. It’s the easiest and safest child care billing software out there.

Take control of your tuition collection by initiating recurring payments on a weekly or monthly basis, or on a schedule of your choice.

Tuition Express is fully integrated with Procare’s software solutions, making tuition collection a seamless experience for child care providers. The platform was built with parents in mind, allowing for convenient online and secure payments that ensure you get your tuition on time.

Request a free demo to learn how software from Procare can help you run and grow your child care business.