Which Program Works for You?

| Do You Need… | Loan Program |

| …capital to cover the cost of retaining employees? | Paycheck Protection Program |

| …a quick infusion of a smaller amount of cash to cover you right now? | Economic Injury Disaster Loan or Emergency Economic Injury Grant |

| …to ease your fears about keeping up with payments on your current or potential SBA loan? | Small Business Debt Relief Program or Small Business Express Bridge Loans |

| …just some quality, free counseling to help you navigate this uncertain economic time? | Resource partners |

We encourage you to use the Decision Trees for the Paycheck Protection Program and Economic Injury Disaster Loan Program to see if you qualify for these financial aid options.

Paycheck Protection Program

Prioritizes millions of Americans employed by small businesses by authorizing up to $349 billion toward job retention and certain other expenses. Small businesses and eligible nonprofit organizations, Veterans organizations, and Tribal businesses described in the Small Business Act, as well as individuals who are self-employed or are independent contractors, are eligible if they also meet program size standards.

Under This Program

- Eligible recipients may qualify for a loan up to $10 million determined by 8 weeks of prior average payroll plus an additional 25% of that amount.

- Loan payments will be deferred for six months.

- If you maintain your workforce, SBA will forgive the portion of the loan proceeds that are used to cover the first 8 weeks of payroll and certain other expenses following loan origination.

Paycheck Protection Program (PPP) Eligibility

- Businesses and entities must have been in operation on February 15, 2020.

- Small business concerns, as well as any business concern, a 501(c)(3) nonprofit organization, a 501(c)(19) veterans organization, or Tribal business concern described in section 31(b)(2)(C) that has fewer than 500 employees, or the applicable size standard in number of employees for the North American Industry Classification System (NAICS) industry as provided by SBA, if higher.

- Individuals who operate a sole proprietorship or as an independent contractor and eligible self-employed individuals. Any business concern that employs not more than 500 employees per physical location of the business concern and that is assigned a NAICS code beginning with 72, for which the affiliation rules are waived.

- Affiliation rules are also waived for any business concern operating as a franchise that is assigned a franchise identifier code by the Administration, and company that receives funding through a Small Business Investment Company.

Loan Forgiveness

The loan will be fully forgiven if the funds are used for payroll costs, interest on mortgages, rent, and utilities (due to likely high subscription, at least 75% of the forgiven amount must have been used for payroll). Loan payments will also be deferred for six months. No collateral or personal guarantees are required. Neither the government nor lenders will charge small businesses any fees.

How to Apply

You can apply through any existing SBA 7(a) lender or through any federally insured depository institution, federally insured credit union, and Farm Credit System institution that is participating. Other regulated lenders will be available to make these loans once they are approved and enrolled in the program. You should consult with your local lender as to whether it is participating in the program.

Lenders may begin processing loan applications as soon as April 3, 2020. If they determines you are eligible, you will receive a loan closing document for your signature. Depending on the lender, timing ranges from a few days to a few weeks.

Sample application

Find a Lender Near You

Economic Injury Disaster Loans (EIDL) and Emergency Economic Injury Grant

In response to the Coronavirus (COVID-19) pandemic, small business owners in all U.S. states, Washington D.C., and territories are eligible to apply for the SBA’s Economic Injury Disaster Loan program. This provides small businesses with working capital loans of up to $2 million that can offer vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing. The Emergency Economic Injury Grants (or loan advance) will provide economic relief to businesses that are currently experiencing a temporary loss of revenue. Funds will be made available within three days of a successful application, and this loan advance will not have to be repaid.

Economic Injury Disaster Loan (EIDL) Eligibility

Those eligible are the following with 500 or fewer employees:

• Sole proprietorships, with or without employees

• Independent contractors

• Cooperatives and employee owned businesses

• Tribal small businesses

Small business concerns and small agricultural cooperatives that meet the applicable size standard for SBA are also eligible, as well as most private non-profits of any size.

Emergency Economic Injury Grant Eligibility

Those eligible for an EIDL and who have been in operation since January 31, 2020, when the public health crisis was announced.

Loan Forgiveness

EIDLs will need to be paid back, but payment is deferred for 6 to 12 months. However, Emergency Economic Injury Grants do NOT need to be repaid.

How to Apply

1.) Visit https://covid19relief.sba.gov/#/

2.) You’ll be asked to choose one of eight business definitions to ensure your eligibility.

3.) You’ll then be asked to check off every item in an eligibility checklist. If you’re unable to check off each item, you are not eligible for this type of loan.

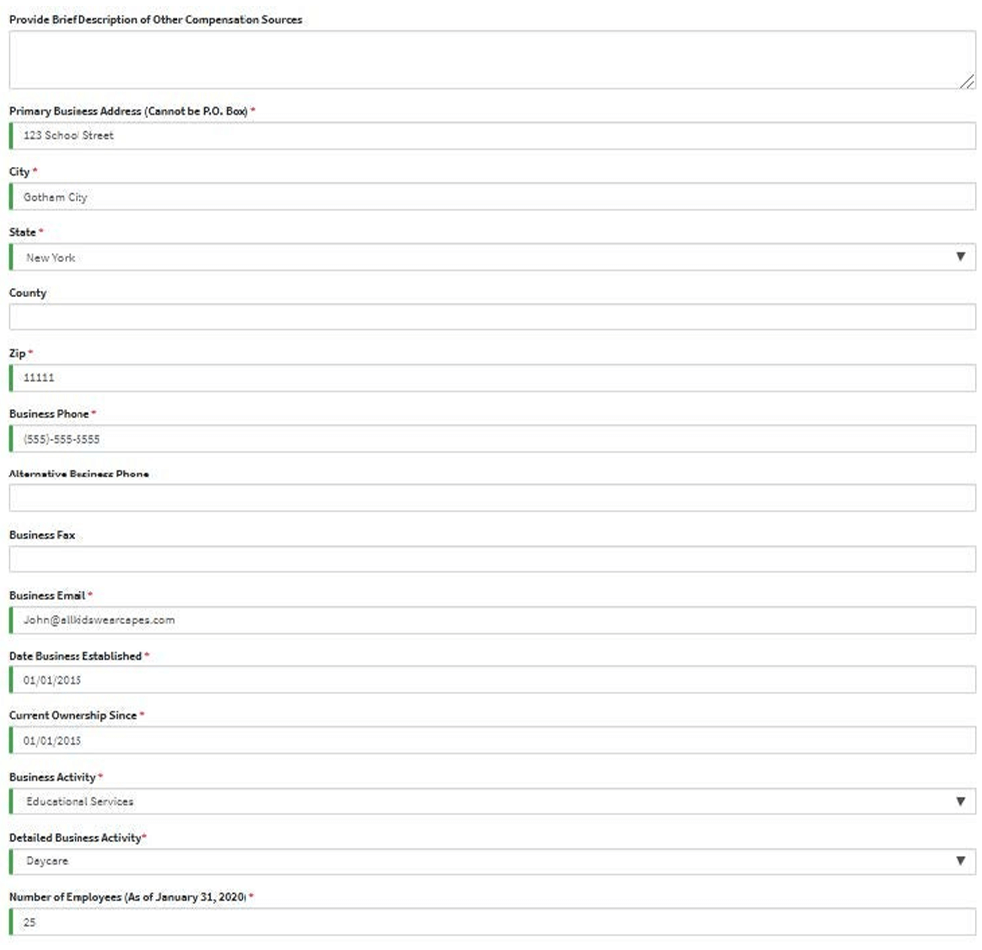

4.) You’ll be asked to continue to the next page, which asks for your business information, including name, organization type, address, establishment date, number of employees, gross revenues, cost of goods sold, rental properties, combined annual operating expenses and compensation from other sources received as a result of the disaster.

5.) Next, you’ll need to fill out the business owner information. Note if there’s more than one, you have the ability to add that additional information.

6.) On the last page, you’ll need to provide additional information, such as your criminal history, and the information of anyone who helped you fill out the application.

7.) You’ll also need to add in your banking information.

8.) Finally, you’ll submit. The SBA says its goal is to arrive at a decision on any disaster loans within two to three weeks. If it determines you are eligible, it will send you a loan closing document for your signature.

More info here: Economic Injury Disaster Loans

SBA Debt Relief & Bridge Loans

SBA Debt Relief

The SBA Debt Relief program will provide a reprieve to small businesses as they overcome the challenges created by this health crisis. These loans include 7(a) loans not made under the Paycheck Protection Program (PPP), 504 loans and microloans. Disaster loans are not eligible.

Under this Program

• The SBA will also pay the principal and interest of new 7(a) loans issued prior to September 27, 2020.

• The SBA will pay the principal and interest of current 7(a) loans for a period of six months.

Eligibility

In general, businesses must meet size standards, be based in the U.S., be able to repay, and have a sound business purpose. To check whether your business is considered small, you will need your business’s 6-digit North American Industry Classification System (NAICS) code and 3-year average annual revenue. Each program has different requirements, see https://www.sba.gov/funding-programs/loans for more details.

How to Apply

To apply, you can visit this site to find the one that’s best for you. You apply for a 7(a) loan with a bank or a mission-based lender.

Find a Lender Near You

https://www.sba.gov/local-assistance

SBA Express Bridge Loans

Express Bridge Loan Pilot Program allows small businesses who currently have a business relationship with an SBA Express Lender to access up to $25,000 with less paperwork. These loans can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing and can be a term loan or used to bridge the gap while applying for a direct SBA Economic Injury Disaster loan. If a small business has an urgent need for cash while waiting for decision and disbursement on Economic Injury Disaster Loan, they may qualify for an SBA Express Disaster Bridge Loan.

Terms

- Up to $25,000

- Fast turnaround

- Will be repaid in full or in part by proceeds from the EIDL loan

Eligibility

- For the COVID-19 Emergency Declaration, small businesses located in any state, territory and the District of Columbia that have been adversely impacted by the COVID19 emergency.

- The small business must have been operational when the declared disaster commenced and must meet all other 7(a) loan eligibility.

Find an Express Bridge Loan Lender

Local SBA District Office

Counseling & Training

If you, like many small business owners, need a business counselor to help guide you through this uncertain time, you can turn to your local Small Business Development Center (SBDC), Women’s Business Center (WBC), or SCORE mentorship chapter. These resource partners, and the associations that represent them, will receive additional funds to expand their reach and better support small business owners with counseling and up-to-date information regarding COVID-19. There will soon be a joint platform that consolidates information and resources related to COVID-19 in order to provide consistent, timely information to small businesses. To find a local resource partner, visit https://www.sba.gov/local-assistance/find/.

In addition, the Minority Business Development Agency’s Business Centers (MBDCs), which cater to minority business enterprises of all sizes, will also receive funding to hire staff and provide programming to help their clients respond to COVID-19. Not every state has a MBDC. To find out if there is one that services your area, visit this site.